Building Your Gene Therapy Value Story From Day One

Cell and gene therapies, also known as advanced therapy medicinal products (ATMPs), are potentially life changing. For patients with rare diseases, they extend the hope of a longer, healthier life and even of a cure. But these therapies are exceptionally expensive with up-front costs ranging from $500,000 to $2 million. Additionally, some incur heavy ongoing costs throughout the life of the patient.

For health technology assessment (HTA) organisations – which must balance clinical effectiveness, safety and efficacy with cost effectiveness, social outcomes and ethical considerations – the decision to support market access for ATMPs is a complex one. Budget constraints mean HTAs and insurers often must make tough decisions balancing the ATMP reimbursement with a reduction in spending elsewhere in the healthcare system. Consequently, therapies that are not viewed as compelling, face rejection. Moreover, the decision-making process can vary from region to region: vastly different decision criteria, for example, are adopted in the UK, the USA and China.

In the UK, for example, the National Institute for Health and Clinical Excellence (NICE) has put in place procedures for evaluating ATMPs and other specialised technologies for rare diseases within the broader context of the incremental cost-effectiveness ratio, which places a cost value on quality of life gained. In the US, where private insurance is employment related, a large element of the cost of ATMP treatment is often the responsibility of the employer, who may factor in the likelihood of the person subsequently leaving their job in considering any approval for treatment. In China, meanwhile, evaluation is based not just on the patient but on the broader care circle. Considerations might include: Will the individual be a productive member of society? How many people will have to take time off to look after them? If the individual is a child, how many days of school will they miss and will they be able to take their exams?

These are complex scenarios for companies to work through when proving the value of their product. However, regardless of the market, one factor that is present throughout is the data and the story it tells.

A needle in a haystack

As everyone working with ATMPs for rare diseases knows, one of the big challenges is finding the specific target mutations for diseases with small populations – the proverbial needle in a haystack.

By way of example, a company developing a targeted gene therapy for a mutation of a rare disease faces a two-fold challenge. Not only do they need to find that population of patients for study purposes – comprising perhaps just 2% of people with the rare disease – but they also must demonstrate the value to potential investors. To do that, they need accurate data about patient numbers, cost of manufacturing and potential upfront reimbursement from payers.

To achieve the objectives of bringing ATMPs to market, small companies depend on progressive investment companies and forward-thinking financial solutions businesses focused on the biopharma industry. Those investment businesses, in turn, depend on clear data to demonstrate the value of the product under investigation. For that, they need data intelligence that can provide evidence early on about the market potential, helping to reduce the risk for manufacturers and payers and support continued research into the therapy.

Changing the game with accurate data

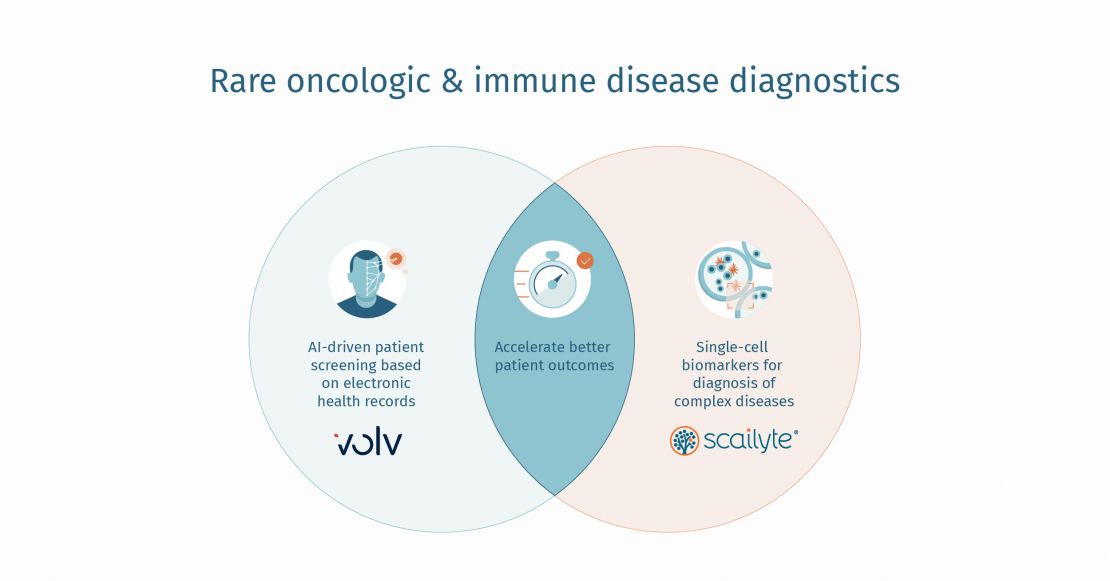

This is where a differentiated approach to artificial intelligence, designed to identify patients at risk of difficult-to-diagnose diseases, can be a gamechanger. Volv’s proprietary methodology, InTrigue finds signals from sparse data sets to produce robust prediction models. The first step in Volv’s inTrigue methodology is to understand the true prevalence of a disease.

Typically, prevalence is assessed by sifting through various research papers, which can often be at odds with one another. Medical teams will tend to be more cautious in their assessment while commercial teams will often push forward the case for a larger number of patients than may necessarily be accurate. This approach presents huge problems for all parties.

Volv’s approach is to look at the evidence with no bias and to derive real prevalence from the data, rather than from sub samples, by looking at country datasets that are representative of the whole country to assess how many people are true targets for treatment. This data is essential when building the case for market potential.

Volv goes further along the journey to build the value story by taking the data about prevalence to assess where patients are in their healthcare journey and help companies to find those individuals, both through electronic data as well as the location of clinicians to diagnose those patients. If a disease has reduced penetrance or expression, the model can also potentially detect those at-risk patients. Penetrance refers to those individuals with a specific gene change who show signs and symptoms of a genetic disorder. When people with the mutation don’t develop these symptoms, the disorder is said to have reduced penetrance. This allows product developers to segment the population they wish to prioritise and share that data with HTAs and other payers for a true reimbursement picture.

This level of detail is not only important for companies and their investors, but crucially also for HTAs, which can then use information about real prevalence to set the appropriate level of reimbursement. For HTAs such as NICE this could eliminate the risk to the system by knowing the total likely population of patients up front, rather than finding out too late that they have approved a high-price drug for far more patients than estimated. It is this obvious risk that makes HTAs extremely cautious about approving ATMPs, and this caution can either block an approval or force the approval to follow an exceptionally long and complex process.

Having this level of detail also benefits the biopharma company: they now have access to true prevalence data that allows them to address more patients, albeit at a reduced price. Furthermore, by providing the HTA with accurate data for reimbursement decision-making, they are helping to maintain good relations with those payers for future product approvals.

Determining patient prevalence with rare and ultra-rare diseases has long been a challenge for industry, investors, and payers. Accurate prevalence data, along with the ability to locate patients that could benefit from a breakthrough ATMP, will enable companies to present their value story from the start of the R&D journey.